Satoshi didn't kill himself: Jeffrey Epstein and the strange death of Bitcoin

World's first cryptocurrency renamed "Pedocoin" as dark questions about the true identity of its creator and funders spread on social media.

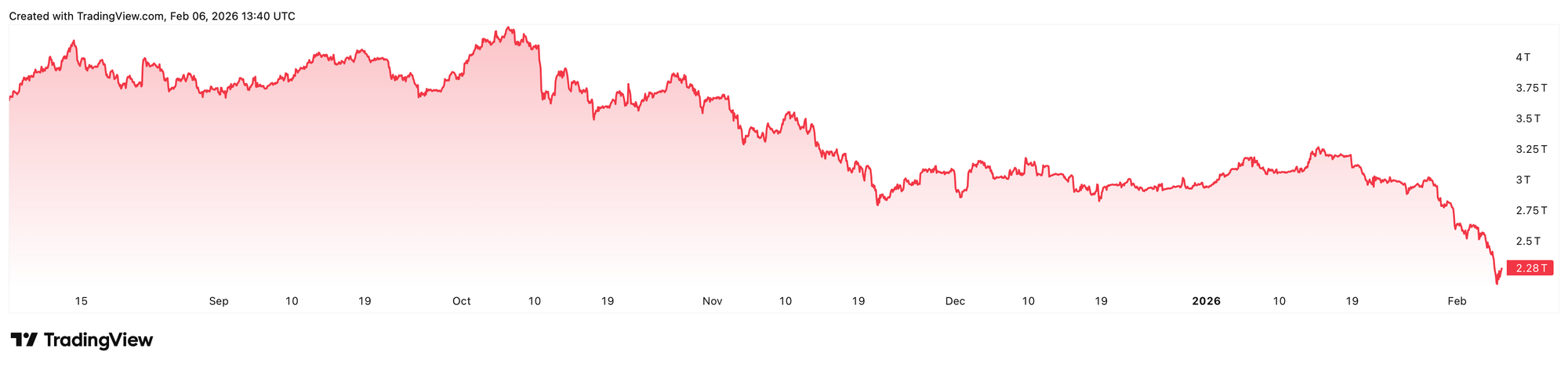

Bitcoin has slumped to its lowest price since September 2024 as wild conspiracies about its origins and ominous predictions about an imminent mega-crash swirl across the internet.

At the time of writing, one Bitcoin costs just £48,725 ($66,274) after hitting an all-time high of £93,500 ($126,200) in October 2025 and then nosediving at the beginning of this year.

This is not necessarily a surprise. In crypto, volatility is part of the game. We expect wild fluctuations, huge highs and crushing lows.

Every time the price drops dramatically, doomers come out to say the end is nigh; that this digital funny money is finally going to zero and all the mugs who put their trust in it are destined for the poorhouse.

Then, on the other side of the debate, hodlers urge the true faithful to cling to their coins and wait for the moment their value soars to the moon so they can retire to some soullessly expensive penthouse in Dubai.

This time around, things look a little bit different. Firstly, an AI crash is looming. It's feared that the productivity gains of GenAI have been massively overrated and a massive repricing is on the way.

Then we have the risk of the so-called "everything bubble" popping. If stocks, crypto, property, and tech really are as overhyped as many observers fear, there is a real danger that everything could crash at once in a disaster of truly epic proportions.

Any macroeconomic disaster would be very bad for crypto, very quickly, because when liquidity dries up and risk appetite dies, the most speculative assets get sold first. Even Bitcoin boosters are considering the worst-case scenario of a total wipeout.

As if all that news wasn't grim enough, a wildcard has unexpectedly come into play: Jeffrey Epstein.

When the Department of Justice released more than three million files relating to the financier, rapist, human trafficker and convicted sex offender this week, they revealed that Epstein directly funded organisations and individuals responsible for developing key aspects of the Bitcoin infrastructure and ecosystem.

This prompted excitable folks to start asking a disturbing question: was Satoshi Nakamoto, the pseudonymous creator of Bitcoin, actually Epstein or one of his shadowy associates?

And if so, does this mean that Bitcoin should be renamed PedoCoin and dumped from any compassionate person's wallet?

Although the answer to the first question is probably no, the shocking truth about Epstein's involvement could be enough to make some people seriously consider the second.

The crash and the chaos

Right now one thing is clear: crypto is in serious trouble. Since that all-time high in October, more than $2 trillion - half the peak market cap - has been wiped off the total market.

This week alone, more than $ 1 billion in crypto was liquidated in less than 24 hours, according to data from CoinGlass.

Over the past fortnight, Bitcoin whales have sold more than 50,000 Bitcoin, whilst there have also been large outflows from spot Bitcoin ETFs, signalling that institutional investors were dumping crypto.

It is also feared that a prominent exchange is facing a liquidity crisis and trying to cover it up by suing people who speak out (an allegation we have been unable to confirm) over fears of sparking a crypto run. We will not be naming this exchange.

If the bloodbath continues, mining may become totally unsustainable, prompting nervous miners to liquidate assets. Currently, it costs $87,000 to mine a single Bitcoin - meaning it is already unprofitable. Another slump and a crash could turn into a crisis.

🚨 HERE’S WHY BITCOIN IS NONSTOP DUMPING RIGHT NOW

— 0xNobler (@CryptoNobler) February 5, 2026

If you still think $BTC trades like a supply-and-demand asset, you MUST read this carefully.

Because that market no longer exists.

What you’re watching right now is not normal price action.

It’s not “weak hands.”

It’s not… pic.twitter.com/a66iY7VACL

In the tweet shared above, DeFi researcher 0xNobler (@CryptoNobler) told his 322,000 followers that Wall Street's involvement in crypto has effectively broken Bitcoin by diluting its scarcity. Piling ETFs, futures, and other derivatives on top of the blockchain means that one Bitcoin can back several financial instruments.

"That is not a free market," 0xNobler said. "That is a fractional-reserve price system wearing a Bitcoin mask."

Jacob King, another major crypto influencer, issued a frightening nightmare scenario in which a crisis sends Bitcoin into a "terminal death spiral towards zero".

READ MORE: Dark web cybercriminals vow to fight on after FBI seizure of Ramp forum

His all-too-realistic description of a notional "catastrophic domino effect of cascading failures" in which ETF outflows and forced liquidations crush liquidity, exchanges freeze withdrawals, and panic spreads from retail to miners to leveraged corporate holders.

As selling spirals, stablecoins (especially Tether) lose credibility and potentially depeg, while miner capitulation and a hashrate collapse make Bitcoin vulnerable to a 51% attack - which is a blockchain takeover that lets attackers rewrite transactions, freeze transfers and wreck trust, triggering a final confidence wipeout and a total systemic meltdown.

King wrote: "The story of Bitcoin mirrors the Titanic. It was said to be unsinkable, but that was never true. You will see."

Here’s how Bitcoin can easily spiral into a worst-case, totally catastrophic domino effect of cascading failures.

— Jacob King (@JacobKinge) February 5, 2026

1. Exchange liquidity gets destroyed under relentless record-selling pressure (record ETF outflows), driving prices lower in a self-reinforcing capitulation loop.… pic.twitter.com/sKiAAdsIKI

The darkest of crypto conspiracy theories

Ever since the first genesis block was mined, speculation over Satoshi Nakamoto’s identity has raged. Potential names have ranged from cryptographers like Hal Finney and Nick Szabo to candidates such as Australian computer scientist Craig Wright and Len Sassaman, a respected privacy researcher and cypherpunk who died by suicide in 2011.

After the latest tranche of files went live, an email titled "Projection Bitcoin fundiner and white paper" sent from Epstein to Ghislaine Maxwell went viral.

"The 'Satoshi' pseudonym is working perfectly," the message said. "Our little digital gold mine is ready for the world. Funding secured."

This email was later exposed as a fake, but there is certainly evidence in the files that links Epstein to the early days of Bitcoin.

READ MORE: Dark web dealers halt US shipments as Trump scraps "catastrophic" border loophole

One email from the archive shows a prominent academic and venture capitalist - who we are not naming for legal reasons - inviting Epstein to a meeting with several other developers who were involved in creating the foundational infrastructure of Bitcoin.

Another message from the same academic to Epstein thanks him for providing "gift funds" that enabled them to fund a media lab focused on developing digital currencies.

Both those messages were written in 2015. By that point, Epstein was already a convicted sex offender:.

He’d been arrested in 2006, took a controversial 2008 plea deal in Florida for soliciting a minor, served a short jail stint with work release, and was widely known - thanks to major reporting and court filings - as a monster who ran a long-term sexual abuse operation involving multiple underage girls.

The Bitcoin folk took his money anyway.

READ MORE: Coinbase cyberheist led by "rogue support agents" could cost $400 million

This shocking revelation prompted a prominent crypto investor to tweet: "At the time this letter was written, there were around 12,000 commits to Bitcoin's code. Today, there are 47,583 commits to Bitcoin's code.

"That means that 74.79% of the Bitcoin core development and code was committed after Jeffrey Epstein took over the de facto senior management role as benefactor. He may not have been 'Satoshi', but he was absolutely running the executive direction of Bitcoin."

He then repeated common allegations that Epstein was working for a non-American intelligence agency and added: "What are the odds that there are backdoors built into Bitcoin's code at this point? Probably about 100%."

In response, an account called Cryto Bitlord with 434,000 followers posted: "We’ve basically funded an elite global pedophile ring since 2015. I feel sick."

The future of pedocoin pic.twitter.com/G29qRoci69

— Eduard Brichuk (@EduardBrichuk) February 5, 2026

Ill be honest I thought he was a scammer talking a track

— Merlin Capital 🧙♂️ (@merlinscapital) February 6, 2026

Pena on Pedocoin, I tip my hat

pic.twitter.com/a8VYaMTf5n

READ MORE: #CryptoCrash: Trump tariffs blamed for $232 billion market slump

Of course, Epstein is probably not Satoshi. We still don't know who Nakamoto is or was, and may never find out.

In the past, that anonymity was a virtue. It painted a picture of Satoshi as a selfless genius working to upend an unfair financial system.

Then big money got involved and turned crypto into an investment vehicle, neutering its revolutionary spirit and blunting its threat to the global financial order.

Now the crypto world is earnestly considering the possibilty that Bitcoin was dreamed up by dark forces for unknown ends. Whether true or not, that question will have an impact.

After his apparent death in custody, the meme "Epstein didn't kill himself" was used to sum up the suspicion many people held towards official narratives of this death.

Will the growing scepticism around Pedocoin and fears of its links to intelligence services and evil figures like Epstein do the same?